Important News:SafeLogic Announces General Availability for CryptoComply for Go! Learn more!

Cryptography and Encryption for Financial Services Firms

Cryptography is Ubiquitous, Highly Regulated, and Required for Zero Trust

-

Cryptography is everywhere. It is a key security control that enables privacy, security, and trust in our digital world

-

NIST's FIPS 140 standard dates back to 2001 and specifies extensive laboratory testing and certification for cryptography implementations sold to the US government. Numerous additional security frameworks have adopted FIPS 140 as the gold standard for cryptography, including FedRAMP, Common Criteria and CMMC 2.0

-

With all the sensitive data financial services firms handle, strong encryption is essential. The strongest encryption available commercially is in cryptography modules that have been FIPS 140 validated

-

According to recent survey, 70% of financial services are implementing Zero Trust. Cryptography and encryption are core elements of any Zero Trust strategy. Zero Trust is another reason for financial services forms to standardize on FIPS 140 validated cryptography

Classical Cryptography is Under Threat from the Emergence of Quantum Computers

-

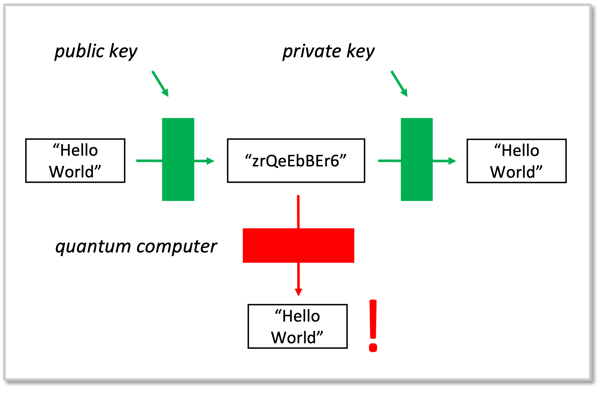

Asymmetric (public/private key) cryptography has been used in almost every aspect of computer security for 30 years

-

Classical PKI algorithms rely on mathematical problems existing computers cannot easily solve, but emerging quantum computers will solve easily

-

Gartner predicts quantum computing will make existing systems unsafe to use cryptographically by 2029

-

Cryptographic products and services will need to be updated or replaced to use post-quantum cryptographic (PQC) algorithms to protect against this threat

-

NIST is standardizing PQC algorithms in the summer of 2024 after an extensive 5+ year evaluation process. Once standardized, they will be added to FIPS 140

Even Without Quantum Computers Today, 'Harvest Now, Decrypt Later' is Already a Critical Threat to the Financial Services Industry

-

In the realm of cybersecurity, the "Harvest Now, Decrypt Later" (HNDL) threat has emerged as a significant concern, particularly for the financial services sector

-

This nefarious strategy involves adversaries collecting encrypted data today in anticipation of decrypting it in the future, once quantum computing capabilities mature

-

The financial services sector is rich with sensitive data, making it an attractive target for HNDL attacks.

-

There are five reasons why the financial services industry must be particularly vigilant: highly sensitive data, regulatory compliance, long-term data value, the potential for operational disruption, and R&D and proprietary information

-

This looming threat underscores the urgent need for financial services firms to adopt robust, quantum-resistant cryptographic measures

SafeLogic is an Ideal Strategic Cryptography Software and Services Partner for Financial Services Firms

Financial services firms including banks, investment houses, lenders, finance companies, real estate brokers, and insurance companies face daunting requirements for next-generation cryptography: comprehensive solutions that interoperate with their entire tech stack, manageable deployability both now and in the future as the world transitions to post-quantum cryptography, and compliance with ever-changing regulatory frameworks starting with the transition to FIPS 140-3.

Trusted by many of the world's top firms, SafeLogic expedites and streamlines the adoption of FIPS 140-validated classical and post-quantum cryptography. Our holistic and interoperable cryptographic solutions save our customers time, effort, and money while ensuring their use of the strongest cryptography available.

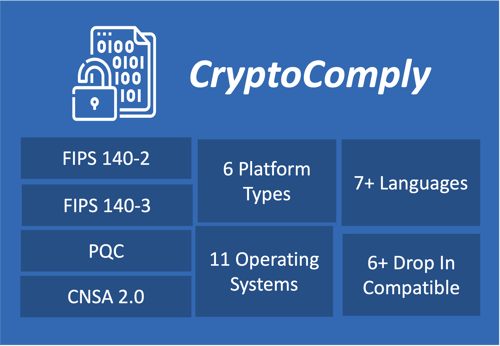

CryptoComply is a Family of FIPS 140 Validated, 'Drop In Compatible' Cryptographic Software Modules

-

Provides 'drop-in compatibility' as direct replacements for popular open-source cryptography libraries

- Performs core cryptographic functions, including secure key management, data integrity, data at rest encryption, and secure communications with robust algorithm support

-

Supports an ever-growing list of platform types, operating systems, and programming languages

-

Provides the basis for CMVP and CAVP certification, Common Criteria, FedRAMP, StateRAMP, CMMC 2.0, and DoDIN compliance. Also supports HIPAA and HI-TECH best practices

- PQC algorithm support now available to customers via an Early Access Program